By Rose Mary Petrass

Australia’s east-coast gas market is again at a turning point. In June 2025, the Federal Government launched a comprehensive Gas Market Review, and one of the key options now on the table is a new export-permitting regime that would more tightly link LNG export permissions to contributions to the domestic market.

It would be the latest step in a long line of interventions designed to tame prices and secure east-coast supply, but it also has the potential to become the enduring framework that replaces today’s patchwork of emergency and quasi-emergency measures, from the Gas Market Code to the Australian Domestic Gas Security Mechanism (ADGSM) and the LNG Heads of Agreement.

The direction of policy is not yet settled. But the next 18 months – as the Gas Market Review progresses, the Gas Market Code’s $12/GJ “reasonable price” is reassessed, and AEMO advances its East Coast Gas System reforms – will go a long way to determining how gas is governed as the NEM decarbonises.

A crowded reform agenda

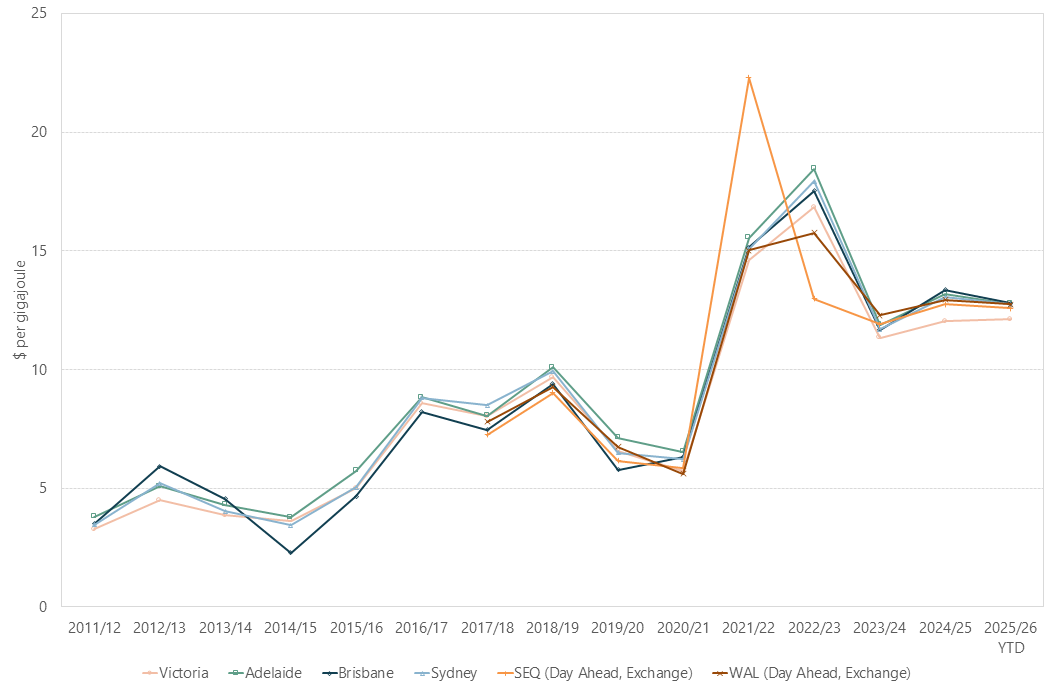

The Gas Market Code, made mandatory in mid-2023, currently anchors wholesale negotiations with a price cap set at $12/GJ, which functions as the Code’s “reasonable price” benchmark. It also imposes minimum conduct, process and transparency obligations on producers selling into the east-coast market. Under the Government’s design, that price cap is subject to a review commencing by 1 July 2025; following that review, the Government – informed by ACCC advice – can decide whether the cap should be maintained, adjusted or removed.

In parallel, the Commonwealth has opened the broader Gas Market Review, announced on 30 June 2025 with a consultation paper dated July 2025. The review is explicitly tasked with examining whether existing instruments – the Gas Market Code, the ADGSM and the Heads of Agreement – are still effective and coherent, and with considering long-term policy settings that secure supply, support efficient prices and align with Australia’s emissions-reduction and net-zero commitments.

This is where export permitting has moved to centre stage. Stakeholders including Manufacturing Australia, Australia Pacific LNG (APLNG) and the Australian Workers’ Union (AWU) have all called for some form of national gas reservation or export-permit scheme that would require LNG exporters to demonstrate a net contribution to domestic supply as a condition of continued exports – whether via a “net contributor test” under a strengthened ADGSM, or via a new Commonwealth export-permit framework with explicit domestic obligations.

Against that backdrop, the question for industry is not whether the Commonwealth will keep intervening, but how.

What an export-permitting model could do

In broad terms, an export-permitting framework would formalise the link between LNG exports and domestic supply. Producers would secure export permissions if they could show they were meeting defined domestic obligations, whether through direct sales to local buyers or through contribution tests built into the permit regime. This is consistent with options canvassed in the Gas Market Review, which expressly flags export permits with domestic-supply conditions as a possible replacement or evolution of the current ADGSM and Heads of Agreement architecture.

For Origin Energy’s Andrew Thornton, Executive General Manager – Integrated Gas, that kind of “prospective reservation” could be a pragmatic way out of the current regulatory tangle.

“Origin supports the further development of an export permitting model as a flexible, market-based solution to assure domestic supply,” Thornton told Energy Insights.

“As a form of prospective reservation, an export permitting framework would give producers assurance about exports in return for a defined domestic supply obligation, creating stronger incentives to invest in new supply. At its core it’s new supply and sustainable, available volumes that will put downward pressure on price.”

Thornton also stressed that gas policy cannot be separated from NEM reliability.

“Origin supports an enhanced NEM design that encourages the necessary investment in renewable energy, firming capacity including gas power generation that will support the transition,” he said.

“Having the right regulatory settings around gas to ensure sufficient supply volumes are available for gas-fired generation will be essential in managing renewable supply and storage shortages, as well as during periods of high demand.”

In other words, an export-permit model that credibly guarantees domestic volumes for both industry and gas-fired generators could help stabilise expectations during the transition, while giving LNG projects more certainty about what they must deliver to keep exporting.

The details will make or break it

Not everyone is convinced that another layer of intervention will solve the market’s structural problems. MST Marquee Head of Energy Research, Saul Kavonic, is blunt about the risks if the scheme is poorly designed.

“The bigger issue with any policy change will be getting the details right. We can see how a new reservation policy could partly deliver the desired political outcome of lower domestic price pressure (albeit with some trade-offs). A wholesale replacement of the current regulatory mess (Code, ADGSM and HOA) with a new well-designed reservation policy could present a less bad outcome, and put an end to the endless cycle of increasing interventions,” the energy analyst told Energy Insights.

“But carelessness in the details could see the whole thing become a bigger debacle, and the Government’s track record so far has been one of messing up details on gas policy. If any new reservation policy doesn’t get the details right, and isn’t accompanied by removing supply-side obstacles, the market will face more interventions in the next few years, making the supply and price situation even worse.”

Kavonic sees the past decade of ad-hoc measures as a core reason today’s prices are elevated.

“We don’t support either the current policy framework, or a new retrospective reservation, or the previous policy frameworks since 2015. We think the constant interventions in the market since 2015 – alongside other hostile policy changes regarding approvals – are the biggest cause of higher gas prices today,” he explained.

“Less interventions, and allowing a supply side response, would have provided a sustainable solution by now. But we are where we are and the political imperative is to intervene again: it’s just a question of how, as Government assesses ‘less bad’ options that offer a path of lower political resistance."

AEMO quietly rewires the plumbing

While the political debate plays out in Canberra, AEMO’s East Coast Gas System (ECGS) reforms are quietly rewiring the system’s technical underpinnings.

Stage 1 of the reliability and supply adequacy (RSA) reforms has already been operationalised (ahead of winter 2023), expanding AEMO’s powers under the National Gas Law, National Gas Rules and National Gas Regulations to monitor, signal and manage shortfall risks across the east-coast gas system.

Stage 2, now progressing through the AEMC’s rule-change processes in 2025, would add an explicit gas reliability standard informed by the value gas customers place on reliability (VGCR), a formal Supplier of Last Resort mechanism, new notice-of-closure obligations for major gas infrastructure and an ECGS-specific Projected Assessment of System Adequacy (Gas PASA) to provide short-term and 12-month supply visibility.

Those reforms will not decide whether export permits become the new centrepiece of gas policy. But they will determine how any new framework interacts with the physical system: how supply shortfalls are forecast, how reliability is defined, and how the market manages exit and scarcity.

Taken together, the Gas Market Review, the Gas Market Code price review and the ECGS reforms mark a genuine inflection point. A well-designed export-permitting regime, aligned with stronger system-adequacy tools, could finally give the east-coast market a coherent long-term framework. A poorly executed one risks locking in yet another cycle of short-term fixes, supply uncertainty and political blame-shifting – just as the NEM’s reliance on gas as a firming fuel is under its greatest scrutiny.

To learn more, meet Andrew, Saul and others at ADGO 2026 this March in Sydney.